Free label: Your card,

your rules.

National coverage, no brand, no acquirer networks.

What is the PIXCARD really?

Private Label ❌White Label ❌Free Label ✅

What is EPC?

Credit Provider Entity

EPC is an acronym used in the PIXCARD ecosystem to designate any type of Credit Provider Entity and its respective customer base, which become users of the PixCard Platform.

The EPC can be a Bank, a Finance Company, a Fintech, a CorBan, or any entity regulated by the Central Bank of Brazil (BACEN).

For a new EPC that wishes to join the platform but is not a regulated entity, PixCard offers options for Direct Credit Societies (SCD) through which the EPC can become a CorBan and operate normally.

This is an excellent option for investors and even small and medium-sized businesses to create their customer bases, credit borrowers, through a free-label virtual card with national coverage, customized with the Credit Provider's identity.

The PixCard Platform allows existing financial entities to create their EPCs and thus expand their customer base and profitability, as well as those interested in entering the credit market in a simple, secure, and innovative way.

Advantages

Exponential growth of your business.

Pixcard fosters the growth of your customer base, always keeping your brand in the spotlight. With our technology, your Credit Provider Entity (EPC) connects to an innovative and disruptive ecosystem without losing control of your customer relationships. The platform allows you to offer customized and flexible credit solutions, ensuring that customer loyalty and trust remain with your brand.

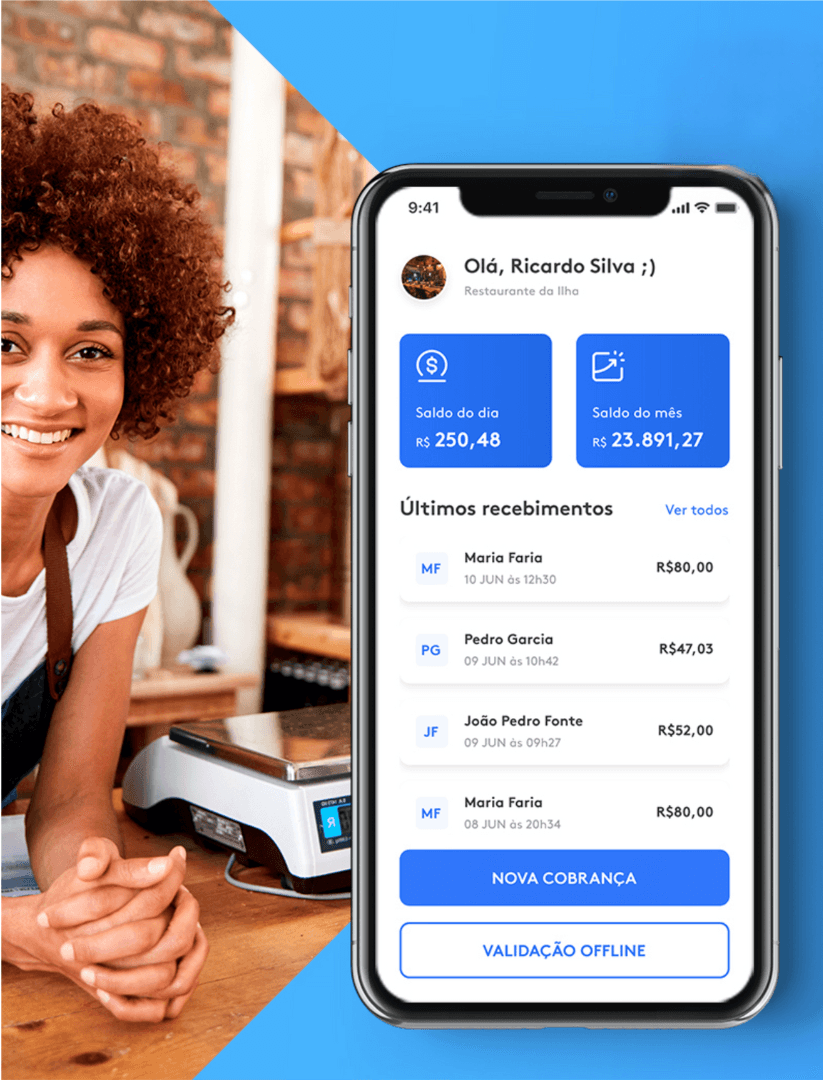

Receiving Party

Every business’s dream has come true.

Always receive payments upfront and become your own acquirer, with no additional costs and complete control over your transactions.

- National coverage

- No installments

- No receivables advance

- No brand

- No paid acquiring

- More competitive prices

Recurring payments

Innovative credit model for the PIXCARD user.

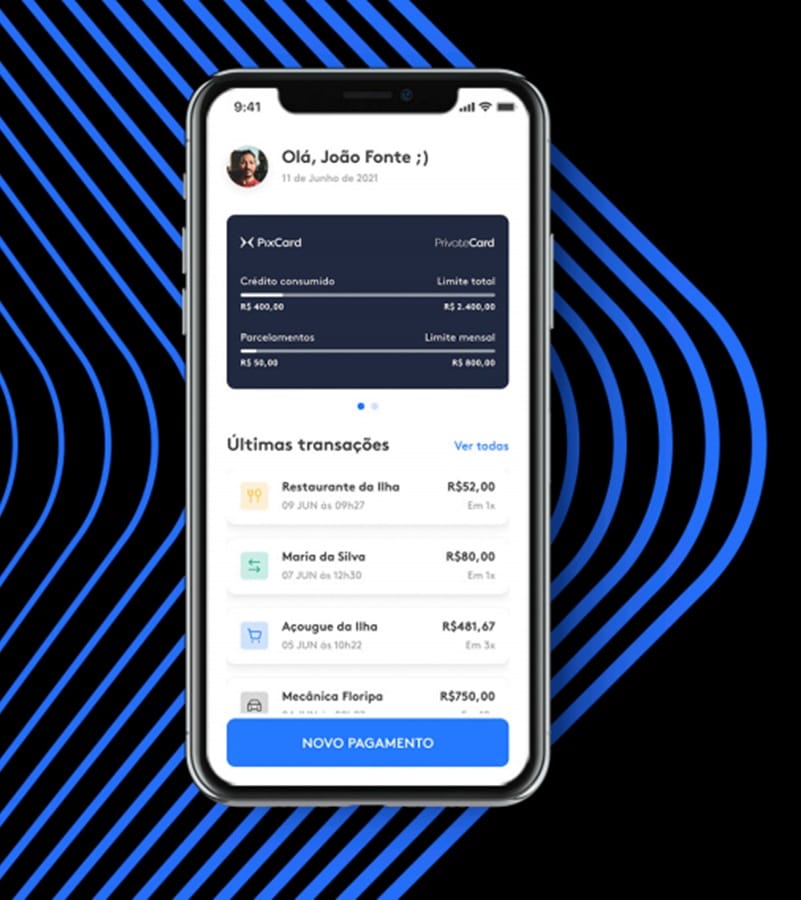

With PIXCARD, the user gains full control, being able to make purchases and payments without needing a bank balance or even a checking account. This promotes financial inclusion, facilitates access to purchases, and allows for instant transactions via PIX, creating a continuous cycle of consumption.

Contact us!

Want to become an EPC?

Let’s talk.

For EPC

Boosted customer base and inclusive credit.

In addition to expanding your EPC’s customer base, PIXCARD promotes significant financial inclusion, especially for the unbanked and low-income individuals. With the LMP (Monthly Installment Limit) control valve, the EPC on the PIXCARD platform offers credit more securely, reducing delinquency and strategically expanding the offering. Additionally, our AI generates detailed user profiles, providing valuable insights to drive the growth of your business.